|

Malaysia is a very open economy, it deals with other countries through

(1). exports and imports of goods and services,

(2). buying and selling of financial assets like bonds and stocks.

A nation’s dealings with the rest of the world affects its exchange rate, reserves level, interest rate, overall economic growth and thus the stock market performance. This explains why trade and the balance of payments data are monitored closely.

(1) External trade

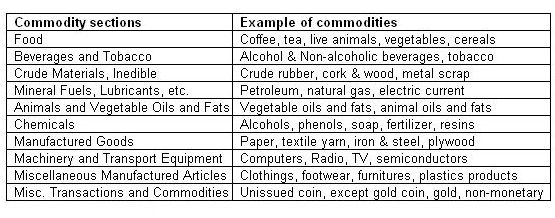

External trade records the exports and imports of goods. In Malaysia’s external trade statistics, goods are classified into 10 broad sections.

Table 7a : Commodity Sections

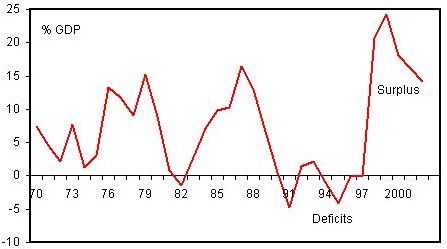

Trade balance refers to exports minus imports.

Figure 7a - When exports are greater than imports, the trade balance is in surplus, vice versa.

Figure 7a : Malaysia's Trade Balance

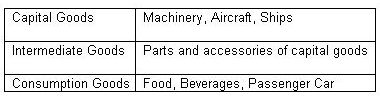

Apart from commodity sections, imports are also classified by broad economic categories.

Table 7b : Imports by BEC Classification

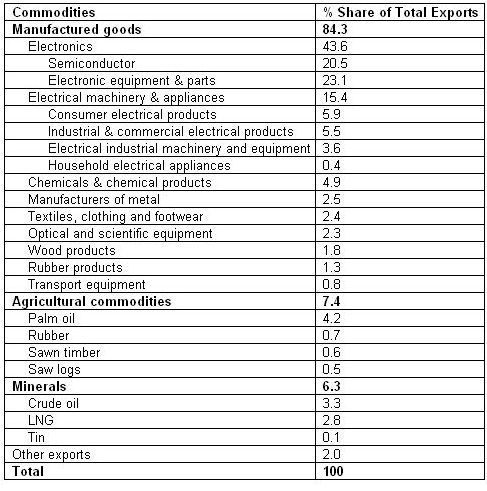

In order to understand how external trade affects Malaysian’s economic performance, we need to know the structure of the trade data by products and by country. Table 7c shows Malaysia’s exports structure in 2002.

Table 7c : Exports Structure

Manufactured products - exports account for more than 80% of Malaysia's total exports.

Electrical and electronic products exports account for more than 60% of Malaysia’s total exports.

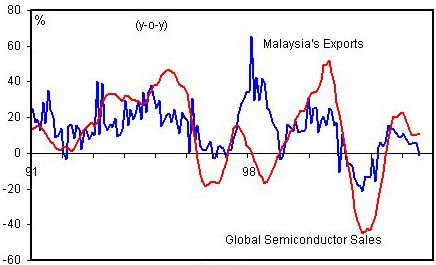

Figure 7b - The condition of the global semiconductor industry has a big influence on Malaysia’s overall export performance. The two indicators move in the same directions. The divergence in 1998 was due to the Ringgit depreciation.

Figure 7b

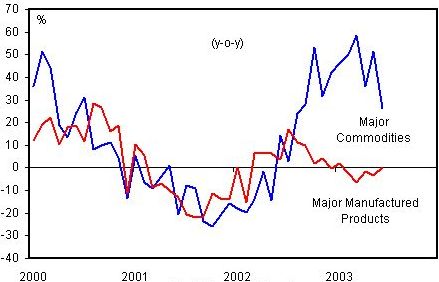

Figure 7c - Although the percentage share of commodities exports is small, it is still important, especially when the global electronics industry is weak.

Figure 7c : Malaysia's Exports

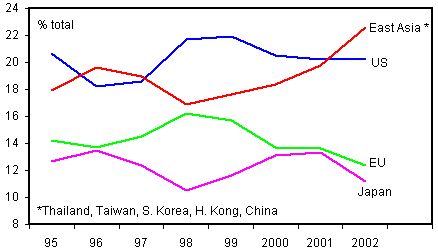

Figure 7d - US is our largest export market (accounts for about 20% of our total exports). Therefore, the US economic condition is important to Malaysia. However, East Asia is becoming an increasing important export market to Malaysia.

Figure 7d : Malaysia's Export Market Share

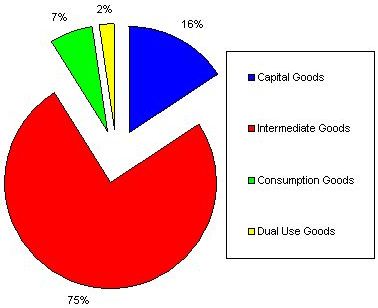

Figure 7e - Shows Malaysia’s import structure by end use in 2002. Intermediate goods are our largest import items. That is why the government constantly emphasizes on the development of the SMI so that the SMI can supply our exporters the intermediate parts that are currently imported.

Figure 7e : Imports by End Use

(2) Balance of payments

Definition : Balance of payments records the transaction of the residents of a country with the rest of the world either through trade or finance.

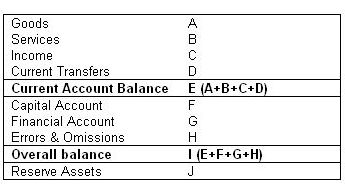

Table 7d - Shows the components of the balance of payments and how they are related.

Table 7d : Components of Balance of Payments (net)

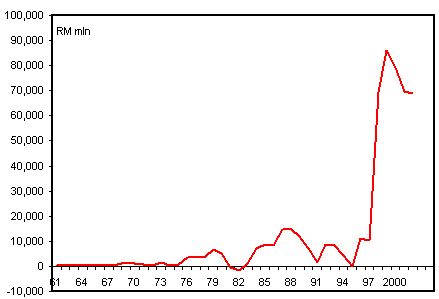

Figure 7f - Malaysia’s goods account is always in a surplus position except in 1981, 1982.

Figure 7f : Malaysia's Goods Account Balance

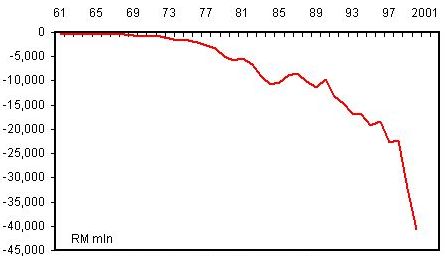

Services account records the transaction of services. Deficit means payments for services are greater than receipts for services.

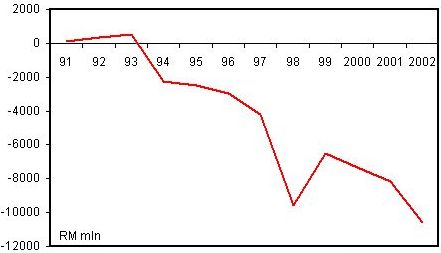

Figure 7g - Malaysia’s services account fared less well, always in a deficit position.

Figure 7g : Services Account Balance

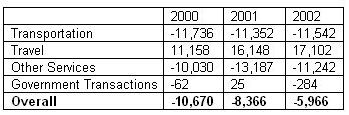

Table 7e - Malaysia’s performance in the services account in the last 3 years.

Table 7e : Services Account (net RM mln)

Transportation - freight charges, port operations.

Travel - travel and education.

Other services - insurance of exports and imports, financial & other professional services.

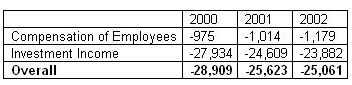

Income account - covers 2 types of transactions, (1) compensation of employees, (2) investment income.

Table 7f : Income Balance (net RM mln)

Compensation of employees refers to wages and salaries. Malaysian working abroad receiving wages represents an inflow of funds. When foreigners working in Malaysia receiving wages, this represents an outflow of funds.

Investment income covers profits and dividends from investment. Malaysia records a large deficit in this account. This reflects the large presence of MNCs in Malaysia.

Current transfers covers gifts, foreign aid and other transfer of goods and services for which no payments are made. For example, remittances by foreign workers. Figure 7h - The large deficit in Malaysia’s current transfers account reflects the large presence of foreign workers.

Figure 7h : Balance on Current Transfers

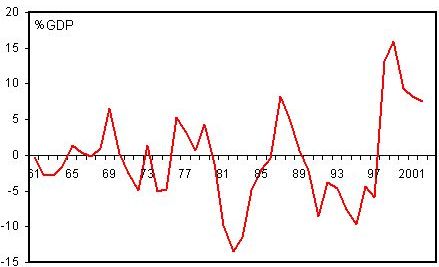

Figure 7i - Malaysia's current account managed to record surplus in some years although the services, income and current transfers account are always in deficits.

Figure 7i : Malaysia's Current Account Balance

Capital and financial accounts record transactions involving fixed and financial assets, tangible and intangibles. Examples are plant, land, stocks, bonds, patents and copyrights.

In Malaysia, there is no record in the capital account because capital transfers are recorded under the financial account.

Financial account covers 3 types of transactions.

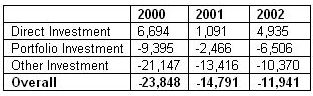

Table 7g shows Malaysia’s financial account balance in the past 3 years.

Table 7g : Financial Account Balance (net RM mln)

Direct investment refers to foreign direct investment. For example, Intel invests RM300 mln in Malaysia. This represents a capital inflow of RM300 mln. When Malaysian invests abroad, capital flows out of the country.

Portfolio investment refers to the buy and sale of stocks and bonds.

Other investment covers trade credits, long & short term loans.

External account must balance

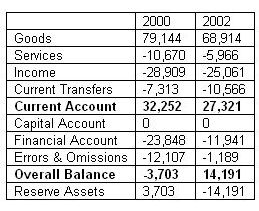

There is a component in the balance of payments called errors and omission. Data on international transaction are often subjected to errors in valuation or omitted. These errors and omission are recorded in the error and omission component. As with a company’s balance sheet, a country’s balance of payments must always be in a balance position. If the surplus in the capital and financial account is not sufficient to cover the deficit in the current account, then the country has to use its reserves to pay for the current account deficit to bring the balance of payments to a balance position. Table 7h shows the years when Malaysia’s BOP is in surplus and deficit. In 2000, Malaysia records a RM3.7 bln balance of payments deficit, this caused Malaysia’s reserves to fall by RM3.7 bln. But in 2002, Malaysia recorded a balance of payments surplus of RM14.2 bln. As a result, the reserves also increased by RM14.2 bln.

Table 7h : Balance of Payments (net RM mln)

Only in theory that the balance of payments is in a balanced position without affecting the reserves position. In the real world, this does not happen. How the balance of payments surplus or deficit affects a country depends on the exchange rate system that the country is practicing. Generally, the various exchange rate systems can be grouped under two broad categories - fixed and flexible.

Fixed Exchange Rate

A balance of payments deficit would put the Ringgit under pressure to devalue, Bank Negara needs to use its reserves to maintain the fixed exchange rate.

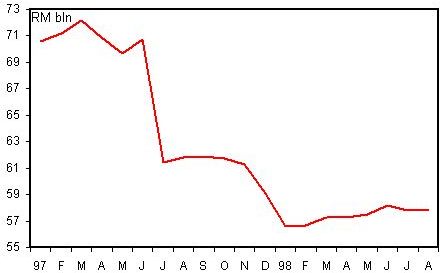

Figure 7j - Reserves can run out fast as shown during the 1997/1998 crisis.

Figure 7j : Malaysia's Reserves

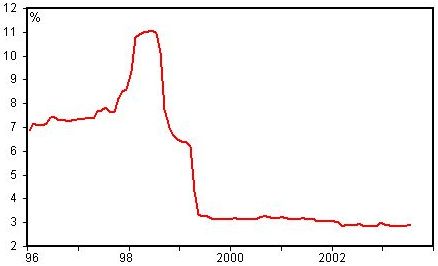

Figure 7k - To defend the fixed rate, interest rates are normally raised too. If after using both measures yet still fail to defend the fixed rate, then the government is left with no choice but to devalue.

Figure 7k : 3-month Interbank Rate

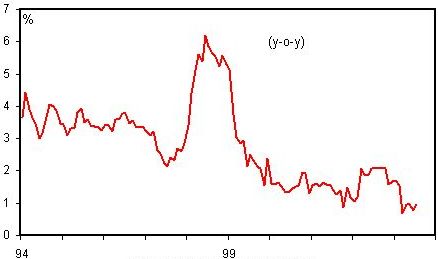

Figure 7l - Shows the sharp jump in inflation rate after the Ringgit devaluation.

Figure 7l : Consumer Price Index

Flexible exchange rate

When the balance of payments is in deficit, central banks don’t intervene to support the falling currency, instead letting the currency to depreciate. However, not all is well because it involves a substantial fluctuation in exchange rate, hence affects business operations.

Policy implications

When the balance of payments is in deficit, one can expect a tighter monetary policy (rising interest rates) and reduction in government spending.

Conversely, when the balance of payments is in excessive surplus, the surplus would flow into the economy, causing money supply to increase. This could create bubbles in the stock and property markets.

|