|

(1) Money supply and interest rate

Definition : Money supply is the total stock of money in the economy.

Money supply can be categorized into narrow money and broad money. Liquidity declines from narrow money to broad money. Narrow money is most liquid. It can be used for transaction purposes immediately. The higher the money supply growth, the greater the liquidity in the economy.

Definition : Narrow money, M1 = Currency in circulation + demand deposits

Currency in circulation = notes and coins in circulation

Demand deposits = current accounts in Commercial and Islamic banks

Definition : Broad money, M2 = M1 + savings deposits + fixed deposits + negotiable instruments of deposits, repos + foreign currency deposits in commercial and Islamic banks

Definition : Broad money, M3 = M2 + deposits placed with other banking institutions

Definition : Interest rate is the price of money.

The rate of interest is determined by demand and supply of money. An increase in money supply causes interest rate to fall and vice-versa.

Central banks influence monetary growth and interest rate level to achieve overall macroeconomic objectives, such as price stability, low unemployment rate and sustained strong economic growth. Central banks policy on money supply and interest rate level are part of what is called monetary policy.

During the financial crisis in 1997/1998, not only the economies of the Asian countries were affected, the whole world was affected. Malaysia’s economy was hit severely.

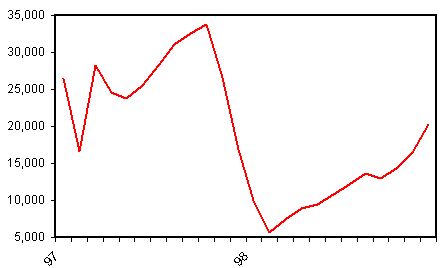

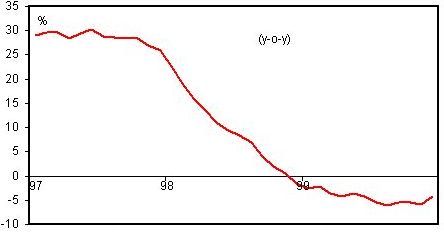

Figure 6a - Exports plunged. Stock market plunged, the KLSE CI fell below 300 points.

Figure 6a : Malaysia's Exports in US$

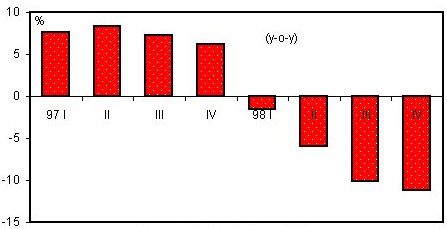

Figure 6b - Consumer spending plunged, businesses failed.

Figure 6b: Malaysia's Passenger Vehicle Sales

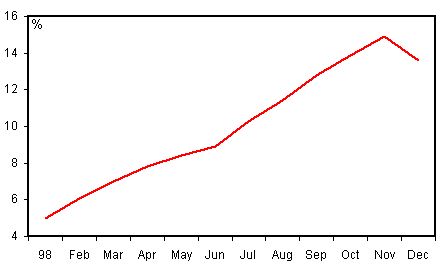

Figure 6c - NPLs jumped from 5% to 15% within a year. Business has difficulty getting credit.

Figure 6c : Malaysia's NPLs

(3) Initial claims

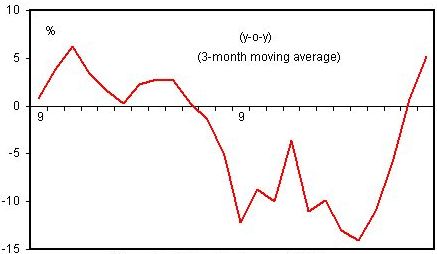

Figure 6d - Bank lending fell.

Figure 6d : Malaysia's Bank Lending

Figure 6e - The economy fell into recession swiftly. In response to this dire economic condition, Bank Negara implemented expansionary monetary policy. It raised the money supply and liquidity of the market by lowering the Statutory Reserve Requirements (SRR) of commercial banks.

Figure 6e : Malaysia's Real GDP

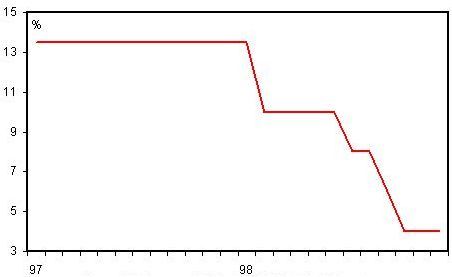

Figure 6f - SRR is the cash reserves placed by commercial banks at Bank Negara. A lower SRR allows banks to have more money to lend out. Bank Negara also cut interest rate, enabling banks to lower their lending rates.

Figure 6f : Commercial Banks SRR Ratio in Malaysia

Table 6a - lists down Maybank's base lending rate.

Table 6a : Maybank’s Base Lending Rate

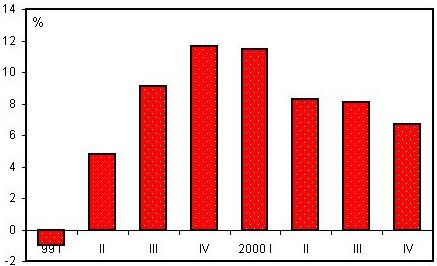

Low interest rate stimulates economic activity, encourages consumer spending (buy car, house) and creates a more conducive environment for doing business. It also makes returns from investment in the stock market more attractive. Figure 6g - Easy monetary policy is part of the reason why Malaysia’s economy recovers swiftly in 1999.

Figure 6g : Malaysia's Real GDP Growth

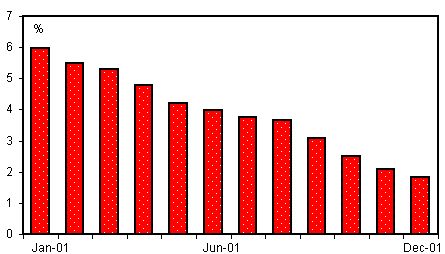

In the US, the Fed did the same thing. Figure 6h - After the technology bubble went bust in 2000, the Fed cut the Fed Funds rate 11 times in 2001, bringing interest rate down from 6.5% to 1.25%. Low interest rate is the main reason why the housing and car industries stay strong, providing a support for the economy.

Figure 6h : US Fed Funds Rate

(2) Inflation/deflation

Definition : Inflation is a continuous increase in the prices of goods and services. This implies a continuous decline in the purchasing power of money.

Definition : Deflation is a continuous decline in prices

Example A : Inflation Scenario

Assume an economy only has one good - apple

Price of 1 apple = 40 sen

Consumer Mr. Lee’s income = RM 100 per month, can buy 250 apples

Seller Mr Tan’s income = 1000 apples @ 0.4 = RM400

Next year, price of apple = 50 sen

Inflation rate = 25%

Consumer Mr. Lee’s income = RM 100 per month, can buy 200 apples

Seller Mr. Tan’s income = 1000 apples @ 0.5 = RM500

Consumer Mr. Lee is worse off

Seller Mr. Tan is better off

Example B : Deflation Scenario

Assume economy only has one good - apple

Price of 1 apple = 40 sen

Consumer Mr. Lee’s income = RM 100 per month, can buy 250 apples

Seller Mr Tan’s income = 1000 apples @ 0.4 = RM400

Next year, price of apple = 30 sen

Deflation rate = 25%

Consumer Mr. Lee’s income = RM 100 per month, can buy 333.3 apples

Seller Mr. Tan’s income = 1000 apples @ 0.3 = RM300

Consumer Mr. Lee is better off

Seller Mr. Tan is worse off

In an inflationary environment, consumer’s welfare would deteriorate by the day, creating potential social unrest. Higher inflation rate also results in greater uncertainties. This affects investment decision making process because in an accelerating inflationary environment, it is difficult to ensure returns are greater than investment.

On the other hand, in a deflationary environment where prices are on a continuous decline, consumer would delay spending. Seller/producer’s profits would be affected, even leading to bankruptcy. Consumer without jobs would reduce spending. When this happens, overall economic activity would slow down.

So, either excessive inflation or deflation is not good to an economy. Central banks always try to maintain price stability.

Inflation is generally caused by demand greater than supply.

During periods of rising inflation, central banks would tighten monetary policy to reduce demand. Some countries set target for inflation. For example, the ECB sets an inflation ceiling of 2%.

On the other hand, during periods of deflation, central banks would ease monetary policy to stimulate demand.

The most common measure of inflation is the consumer price index (CPI).

Malaysia’s CPI is the price index of the goods and services consume by a typical household in Malaysia.

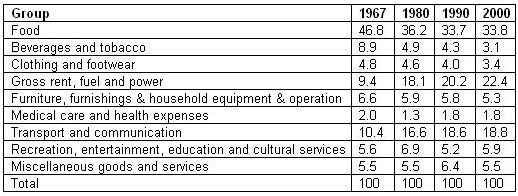

The goods and services are categorized into 9 groups. Table 6b - shows the 9 groupings and their weights in the past 30 years.

Table 6b : The Weights of Malaysia’s CPI

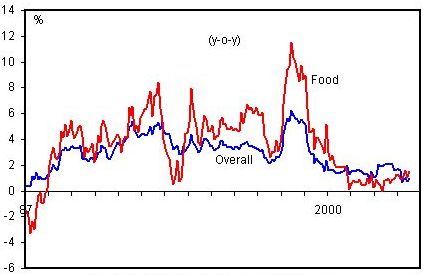

Weights refer to the proportion of consumer’s expenditure. For example, in 2000, out of RM100 spent, RM33.8 is spent on food. Although Malaysia’s standard of living has increased tremendously, food still accounts for a large portion of consumer’s expenditure. Figure 6i - shows the direction of Malaysia’s CPI is largely determined by the movement of food prices.

Figure 6i :Malaysia's Consumer Price Index

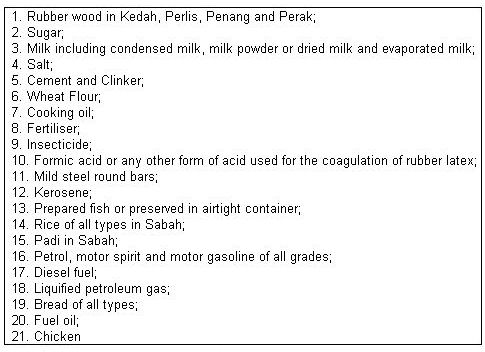

Malaysia’s CPI is influenced to a great extent by the controlled items. Table 6c - Lists down the controlled items.

Table 6c : List of Controlled Items

25 additional items are declared controlled items during the festive season (eg : onion, garlic, dried chilies, coconuts, dried chillies, etc).

The weightage of controlled items in Malaysia’s CPI is about 20%. Another indicator of inflation is the producer price index.

The CPI measures the prices paid by consumers while the PPI measures the prices of goods and services paid by the producer of goods and services. The primary use of the PPI is to project the CPI because when producer faces higher prices, he will pass it on to the consumer.

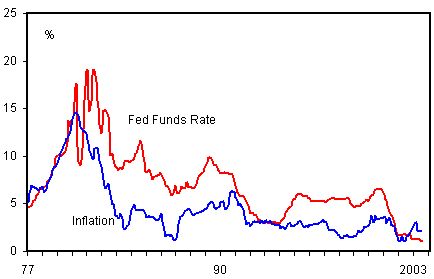

The primary objective of monitoring inflation is to gauge the direction of interest rates. Malaysia’s interest rate movement is less sensitive to the movement of inflation rate. Figure 6j - In the US, interest rate movement is very sensitive to inflation rate movement.

Figure 6j : US Interest and Inflation Rates

|