|

Definition : The index of leading indicators is an index that leads economic activity 6-9 months ahead.

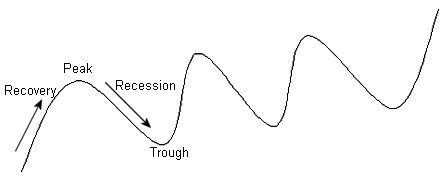

Figure 8a - Economy does not grow in straight line. It shows business cycle patterns, fluctuating from trough through recovery to peak, and then from peak through recession and back to trough.

To invest successfully, one has to always look forward. Strong economic growth generally means better performance in the stock market because stronger economic growth translates into higher profits for companies. From trough to peak, i.e. during recovery phase, corporate earnings growth would pick up, so are stock prices. Conversely, from peak to trough, i.e. during recession phase, corporate earnings would decline, so are stock prices. Therefore, in investing, it is crucial to know the turning points of the business cycle before it actually happens. In essence, it helps investors to buy low and sell high.

Knowing the turning points early also helps investors to reallocate assets among alternative investments and select the appropriate stocks in ones portfolio. For example, during economic downturn, growth in corporate earnings are expected to slow and the inflation rate is expected to be low or even fall into deflation. In this type of environment, it is better to allocate a greater proportion of ones assets to fixed income asset like government securities. Due to the nature of their business, some stocks (for examples companies in staple food products business) are more resilient during recession than others. An early warning of the business cycle turning points allows investors to switch stocks in their portfolio accordingly.

For policymakers, early detection and timely recognition of business cycle turning points is important for them to implement pre-emptive countercyclical policy measures so that the impact of the cyclical downturn could be mitigated.

The early recognition of business cycle turning points also allows businesses to adjust their sales or investment strategies. In short, leading index is a very important indicator.

(1) Malaysia’s composite leading index

Malaysia's leading index is made up of 8 components.

Table 8a - shows the 8 components.

Table 8a : Components of Malaysia’s Leading Index

Money supply - when money supply rises, interest rate falls, demand rises.

Stock price - a reflection of profit expectation, if investors expect profit to rise, they will bid up share prices, vice-versa.

Trade - important for Malaysia. An increase in trade activities would lead to higher economic growth. (8 major trading partners refer to Singapore, US, Japan, UK, Germany, China, HK, Thailand)

Inverted CPI for services - CPI for services is a lagging indicator, so when it is inverted, it becomes a leading index.

Industrial material's prices - industrial materials are at the forefront of industrial production process. When demand rises, industrial material’s prices would increase. This signals an increase in production in the future.

Ratio of Price/ULC - a measure of profit margin. Profit margin grows at a faster pace in the beginning of the growth cycle and slows down near the business cycle peak.

Approved housing permits - leading index for housing industry.

New companies registered - more new companies, higher economic activities ahead.

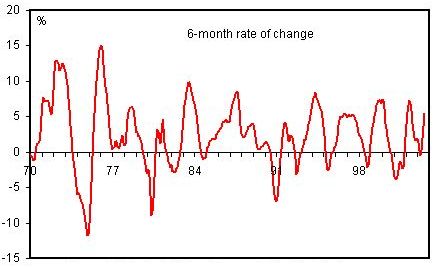

Figure 8b shows Malaysia's leading index. Malaysia's leading index leads business cycle by an average 7 months.

Figure 8b : Malaysia's Leading and Coincident Indices

(2) US leading index

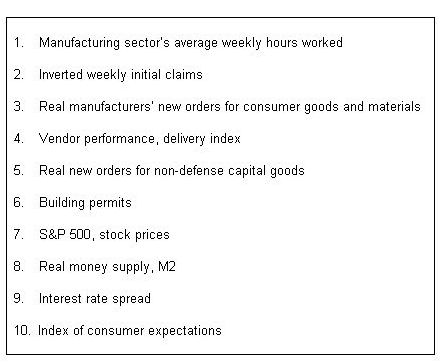

There are 10 components in the US leading index.

Table 8b shows the components of the US leading index.

Table 8b : Components of Malaysia’s Leading Index

When monitoring the US leading index, there is a famous 3-month rule to predict the turning point of the economy. 3 consecutive monthly declines (or increases) in the leading index indicate a coming recession (or recovery). According to a study using data from 1960-1991, the average lead time using the 3-month rule for predicting a recession in the US was 4.8 months. However, it is not a rule that always work, so use this rule with care.

(3) OECD leading index

A composite leading index for the OECD countries. Monitoring the development of the global economy is very important especially for an open economy, like Malaysia. The 30 OECD countries produce about 2/3 of the world’s goods and services. So, it is used to gauge the world economic condition.

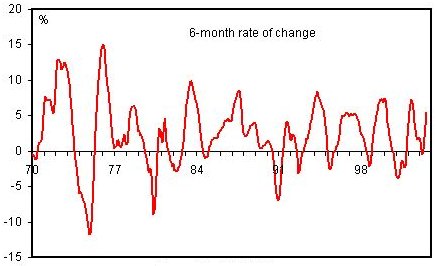

Figure 8c shows the OECD's leading index.

Figure 8c : OECD CLI

(4) Singapore’s Composite Leading Index (CLI)

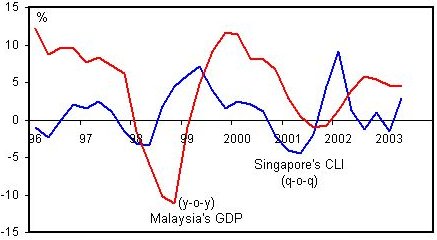

Figure 8d shows Malaysia’s GDP and Singapore’s CLI. Malaysia and Singapore’s economy are relatively similar. Before Malaysia develops its own leading index, Singapore’s CLI is used to forecast Malaysia’s economic activity. Now, it can be used to compliment Malaysia’s CLI.

Figure 8d : Malaysia's GDP and Singapore's CLI

|